As someone deeply involved in affiliate marketing, I noticed a growing trend where many platforms claim to operate in the cryptocurrency space. These platforms often promise high daily returns and additional income opportunities through referrals, presenting themselves as “investment opportunities.”

However, what I eventually uncovered is that many of these platforms are actually cryptocurrency Ponzi schemes rather than legitimate affiliate marketing businesses. They lure people in with flashy promises but end up being scams.

Based on my personal experience and what I’ve learned, I decided to shed light on how to spot these crypto Ponzi schemes. To make it more relatable, I’ll use a real-life example of one such platform as of September 2024.

Unmasking the Crypto Ponzi Scheme

Cryptocurrency Ponzi schemes have become a growing threat in the world of online investments, promising high returns and easy profits. These scams lure in unsuspecting investors by promoting what seems like legitimate platforms, only to leave them with financial losses when the scheme inevitably collapses.

My personal encounter with the 2139 Exchange platform serves as a prime example of how these schemes operate.

At first glance, the platform appeared legitimate, offering high daily returns and a referral program designed to bring in even more users.

However, after some time, issues like blocked withdrawals and lack of transparency surfaced. Eventually, the platform shut down, leaving many investors unable to recover their funds.

These platforms often operate under a facade of legitimacy but are built on a model that requires continuous new investments to pay off older ones. When the inflow of new investors dries up, the entire structure collapses, leaving behind substantial financial losses for those involved.

The Typical Pattern of a Crypto Ponzi Scheme

Crypto Ponzi schemes often follow a similar pattern, using flashy promises and tactics to deceive investors. Let’s break down how they typically work, using my experience with the 2139 Exchange as an example.

1. High Daily Returns

One of the first things these platforms do is promise unbelievable daily returns.

In the case of 2139 Exchange, they claimed you could make a significant profit every day. These kinds of offers are designed to attract people who want fast, easy money.

However, these promises are usually too good to be true, which is a major red flag.

2. Early Payouts

At first, platforms like this often pay out some early investors.

This happened with 2139 Exchange. Many people I knew actually made money in the beginning, and that success was enough to lure in even more investors.

Early success creates a false sense of trust in the platform, making people believe the platform is reliable.

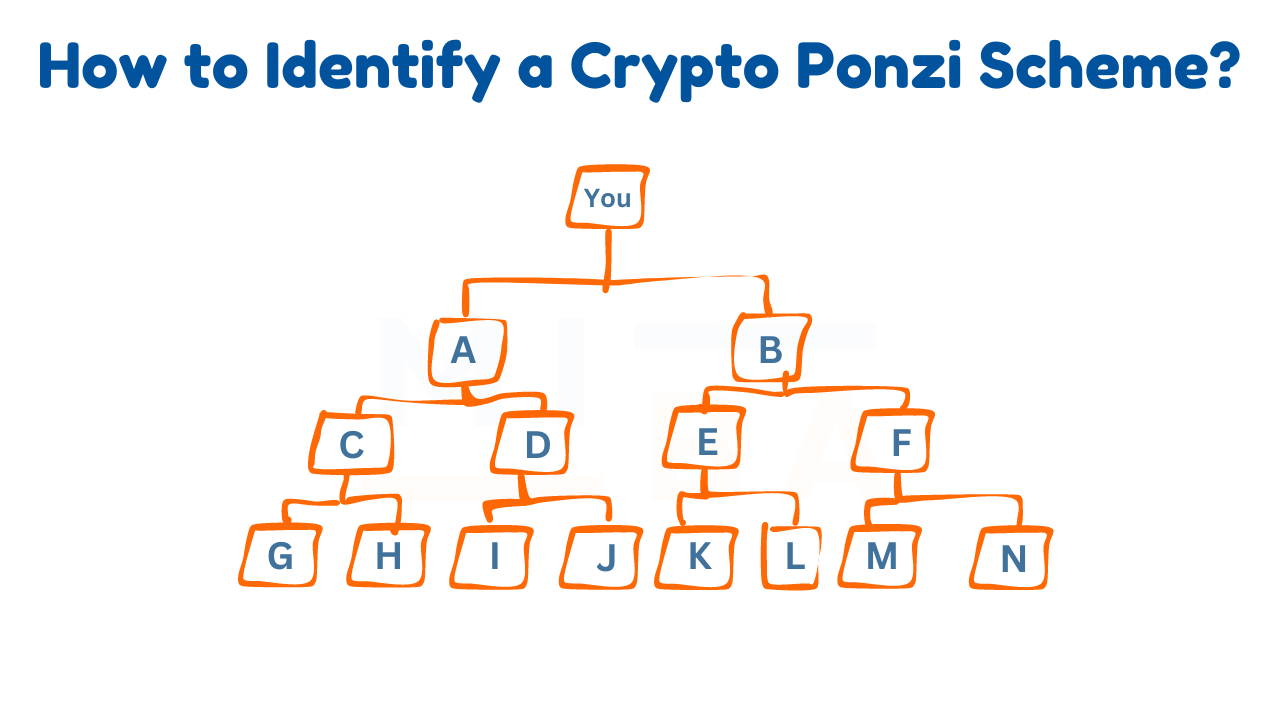

3. Multi-Level Referral Program

Another typical feature is a multi-level referral program. 2139 Exchange encouraged users to bring in new people, offering extra income for every new referral.

They called this an “affiliate program,” but in reality, it’s just a way to keep new money flowing in. The more people you refer, the more you’re supposed to earn, but this only works while new investors are joining.

4. No Feedback from Support

As the platform begins to experience problems, customer support becomes unreachable.

This is exactly what happened with 2139 Exchange. People started complaining about withdrawal issues, and suddenly, no one from the platform responded to inquiries. This lack of communication is another warning sign that something is seriously wrong.

5. Platform Shuts Down

Eventually, the worst happens—the platform shuts down completely.

This was the fate of 2139 Exchange. The website went offline, leaving investors unable to withdraw their funds. Once a platform like this collapses, it’s nearly impossible to recover any lost money.

This pattern is common in crypto Ponzi schemes. Recognizing these red flags early can help protect you from losing your investment in similar scams.

How to Avoid Falling for a Crypto Ponzi Scheme

It can be difficult to spot a Ponzi scheme right away, but by following some basic guidelines, you can protect yourself from falling victim. Here’s how you can avoid getting scammed, based on my experience with platforms like 2139 Exchange.

1. Too Good to Be True?

If a platform promises extremely high returns in a short period, be cautious.

For example, 2139 Exchange claimed daily profits that seemed unbelievable. If it sounds too good to be true, it probably is. Genuine investment opportunities tend to offer more modest, realistic returns.

2. Shady Contact Information

Before you invest, check the platform’s contact information. If customer support is unresponsive or there is no clear way to reach them, that’s a warning sign.

For instance, many users of 2139 Exchange found that their emails and messages were ignored when problems started. Test their email or contact form first—this simple step can reveal a lot about the platform’s legitimacy.

3. New Platform

Look into the platform’s history. You can use websites like Whois.com to check the registration date.

Platforms that have been around for less than a year are generally riskier. 2139 Exchange was relatively new, and in my experience, new platforms are more likely to be scams, since they don’t have a long track record.

4. Anonymous Ownership

Another big red flag is the lack of information about the people running the platform.

Legitimate companies are transparent about their leadership team. In the case of 2139 Exchange, there was no information about the owners, and the few images they used were likely stock photos or AI-generated profiles. Be wary of any platform that keeps its owners or team members anonymous.

5. Fake Reviews

Lastly, always check the reviews of the platform on websites like Trustpilot. But don’t take the reviews at face value.

Some platforms pay for fake, overly positive reviews to create a false sense of trust. Look for balanced feedback, and if you see only perfect scores, that could be a sign of manipulation. In the case of 2139 Exchange, there were suspiciously positive reviews that turned out to be misleading.

By applying these steps, you can avoid many of the common traps that crypto Ponzi schemes set for potential investors. Always do your research and trust your instincts if something feels off.

Red Flags to Watch For

When it comes to identifying a crypto Ponzi scheme, just spotting one red flag can be enough to raise concern. However, it’s always a good idea to look for additional signs before investing, as one warning alone might not confirm a scam. Here’s how you can approach this:

1. Caution with One Red Flag

If you notice one of the warning signs discussed earlier—such as too-good-to-be-true returns, shady contact information, or anonymous ownership—don’t ignore it. Take it as an opportunity to do deeper research.

Being cautious at the first red flag can help you avoid financial losses.

2. Apply Multiple Points

When you see one red flag, take the time to apply the other checks we discussed. For instance, if the platform seems new, use Whois.com to verify its launch date. Then, test the customer support and check for shady ownership information.

The more red flags you find, the higher the chances you’re dealing with a Ponzi scheme.

3. Avoid New Platforms

A simple rule of thumb is to be careful with platforms that are less than 2 to 3 years old. Most Ponzi schemes collapse within 1 to 2 years, so it’s much riskier to invest in new platforms.

However, this doesn’t mean that older platforms are always safe. Even if a platform has been around for more than 3 years, you should continue to apply the earlier guidelines before making any investments.

By paying close attention to these red flags and doing proper research, you can avoid falling for Ponzi schemes and protect your money.

Practical Steps to Protect Yourself

1. Research Thoroughly

Before you invest any money, it’s crucial to research the platform thoroughly.

Don’t just rely on the information they provide on their website. Instead, look for credible sources like independent reviews, forums, or trusted financial news outlets.

Check out what others are saying about the platform and if there are any past incidents of fraud or complaints. Use tools like Whois.com to verify the platform’s registration date and ownership details.

2. Be Skeptical

When an investment opportunity seems too good to be true, it probably is.

High daily returns, minimal effort, and promises of fast wealth are common tactics used by scammers. Always ask yourself, “Why would this platform offer such high returns?”

A healthy dose of skepticism can protect you from falling for these schemes. If something sounds unrealistic, trust your gut and investigate further before investing.

3. Invest Wisely

Even with the best research, every investment carries some risk, especially in unregulated markets like cryptocurrency.

It’s important to only invest what you can afford to lose. If you have doubts about a platform’s legitimacy, it’s better to hold off or invest a small amount rather than risking significant financial loss.

Diversify your investments and avoid putting all your money into one platform, especially those with questionable credibility.

Conclusion

By following the guidelines outlined in this article, you can significantly reduce the chances of falling for a cryptocurrency Ponzi scheme.

These warning signs and tips can help you identify over 65% of scam platforms (my educated guess), potentially saving you time, money, and effort.

While it may take some time to research thoroughly and evaluate a platform’s legitimacy, this extra step can prevent you from making costly mistakes.

Remember, caution is key when it comes to investing, especially with platforms promising high returns in a short amount of time.

If something feels off or too good to be true, trust your instincts and proceed carefully.

By applying these principles, you’ll be in a much stronger position to spot and avoid scams, keeping your investments safe.

Hello Mike,

Can you identify TSAI,

[link deleted]

You have shared all points are there in this system, but fortunately my money has been recovered, if you can do bit research, will help many other people.

Thanks and Regards

Mr Shah

Hi,

The link has been deleted. I think you know why…

The company you mention, I don’t recommend.

Mike